Your Plan

Your Pension

Your Way

Expert Pensions Advice LLP | Pensions & Retirement Specialist

Helping You Write Your Story About Your Best Life

Since 1987, we’ve guided clients through the complexities of pensions and retirement. As one of the UK’s most qualified teams—with MSc, FPFS, CFP Chartered FCSI (Financial Planning), DipFA MLIBF and CII Diploma qualifications—we are the UK’s leading experts in Occupational Final Salary (Defined Benefit) Pensions Advice and holistic Financial Planning Advice with SIPPs and personal pensions.

❖ Pension Transfers

❖ Financial Planning

❖ Expert Pensions

Expert Pensions Advice

Making decisions about your pension and financial future can feel complex and overwhelming. They are important.

We bring clarity and confidence to that process, so that you are making the best-informed decisions.

We are a specialist independent firm dedicated to providing clear, evidence-based financial advice and pension planning for a fixed project fee.

With the technical expertise required to handle even the most intricate cases, including Defined Benefit pension transfers and cross-border pension transfers into Australian SUPERs.

Experience and Expertise

Over 100 years of combined experience, your team have been in pensions since 1987. Led by John Reynolds – one of the UK’s most qualified and respected pension specialists – we provide expert guidance on defined benefit and final salary pension transfers, alongside expert financial planning advice using personal pensions and SIPPs.

Our advice is supported by sophisticated financial modelling and AI tools (as you will see throughout the site and in our work).

Gold Standard Advice

We are authorised, regulated and approved by the FCA.

Our FCA registered details are here: click here

We have a duty of care to you.

Our fees are clearly and openly disclosed, with a focus on fixed pricing and time-based costs wherever possible.

You understand what we are doing at every step before you commit to anything. Please go and have a read through our Insights for more detail.

Remote first with Secure Online Support

All our meetings are held online via a secure Google Meet link, and recordings are recorded for your protection.

Our business is built on the Google Workspace platform.

More details can be found here: click here

We are also supported by the Google suite of AI tools, where ALL data is secure and not used for machine learning purposes.

We use a secure portal for sharing personal data. You can find more here:

❖ Pension Transfers

❖ Financial Planning

❖ Expert Pensions

How we help you

Operational Support

The whole team is batting for you

Stop stressing about unknown scheme administrators and dinosaur pension providers. You don't have to spend 45 minutes on hold with people who don't dance.

Less Stress: When you engage us, you buy the entire team. We handle all of it for you, from dealing with providers on your behalf, obtaining all necessary scheme information and translating your options into clear, plain English.

Expert Pension Advice

We are expert technicians and financial planning advisers for all pensions, including all types of Occupational pensions, including public sector and Defined benefit pensions (including transfers)

We conduct the research, obtain your scheme information and go through all the options on offer from your scheme.

Would like to know more about what we do and what’s included in our advice?

International Pension Transfers

We provide cross-border pension support for Expats living in Australia

We work with licensed and regulated Australian advisers and Tax specialists, supporting clients locally and globally with our ‘‘4 Pillars Approach’’, supporting International Pension Transfers into Australian ROPs (SUPERs)

Would you like to know more about our unique ‘‘Four Pillars’’ approach?

Your Expert Pensions team

Your team have been working with Pensions since 1987…yes, a long time!

-

John Reynolds

Senior Manager

-

Rachel Campbell

Head of Operations

-

Peter Lawlor

Head of Financial Advice

-

Chris Yeates

Compliance and Operational Support

Less stressful and more successful

❖ Pension Transfers

❖ Financial Planning Advice

❖ Expert Pensions

How It Works

1

You book a free, no obligation, no-pack-drill, no-nonsense virtual coffee

Schedule a free, no obligation, no-pack-drill, no-nonsense online video meet for a virtual coffee to discuss your plan, what you want to do with your pension, in your retirement.

2

Our terms of business and fees

We’ll clearly explain your project plan, what is wihtin scope for your project and our fixed fee.

We’ll explain the project, its timescales, the process, and the fees we will charge: fixed project fees that are fair and transparent. Our fees are based on the time and work involved in your project.

We don’t charge a fixed % of your wealth or oblige you to take any ongoing advice beyond your project, your plan and your scope (unless you explicitly agree for any further work).

We don’t start until you are happy with our approach, your plan, your project and our fee.

3

Building your Plan, your way with your Pension

Together, we’ll build a plan and strategy with you. We Advise into your Objectives.

We’ll start with an assessment and discussion about risk and your risk appetite. We’ll agree on what your appetite for risk looks and feels like: appetite and attitude.

We’ll gather a LOT of data about you, your plan and your pensions and investments.

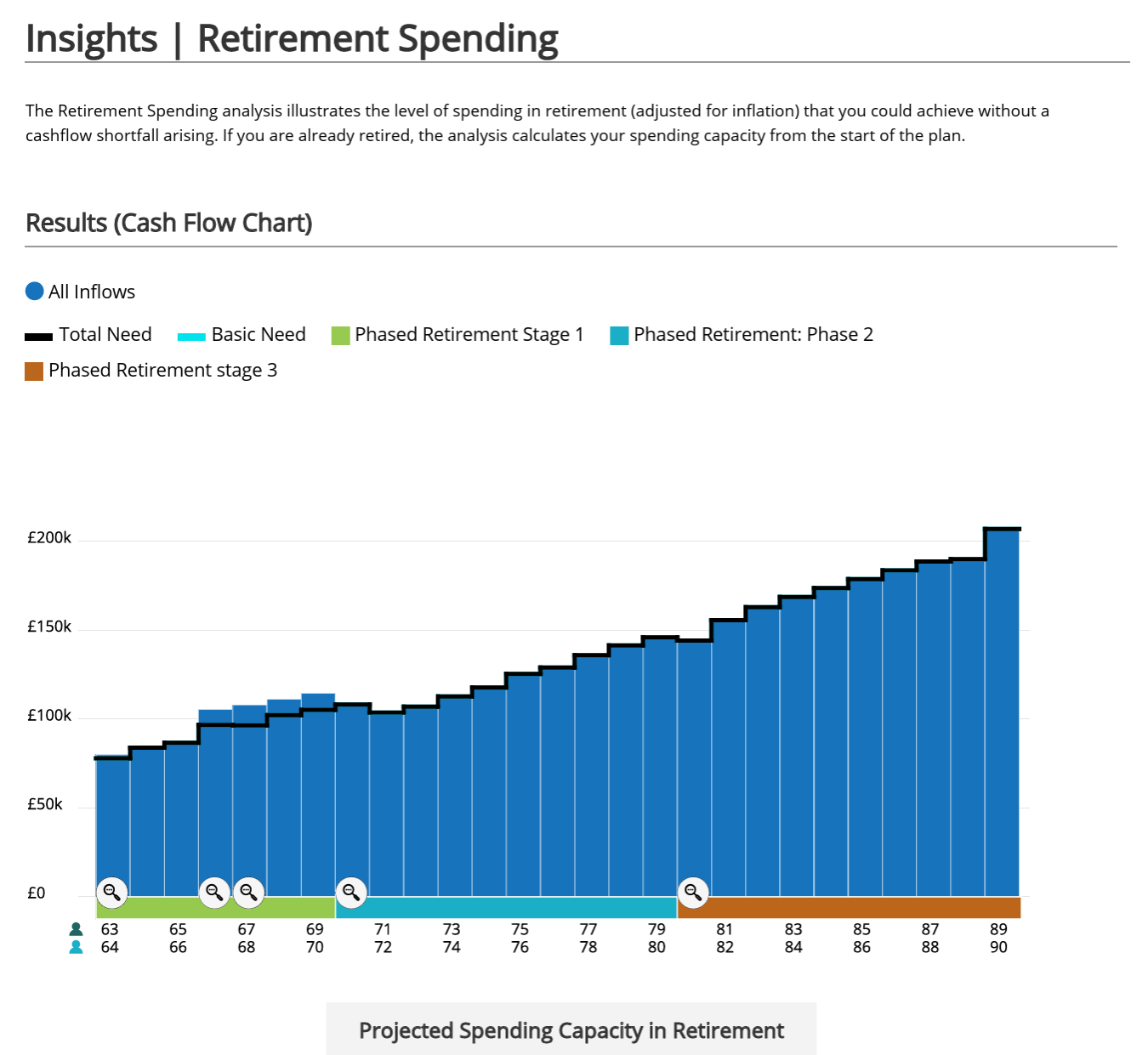

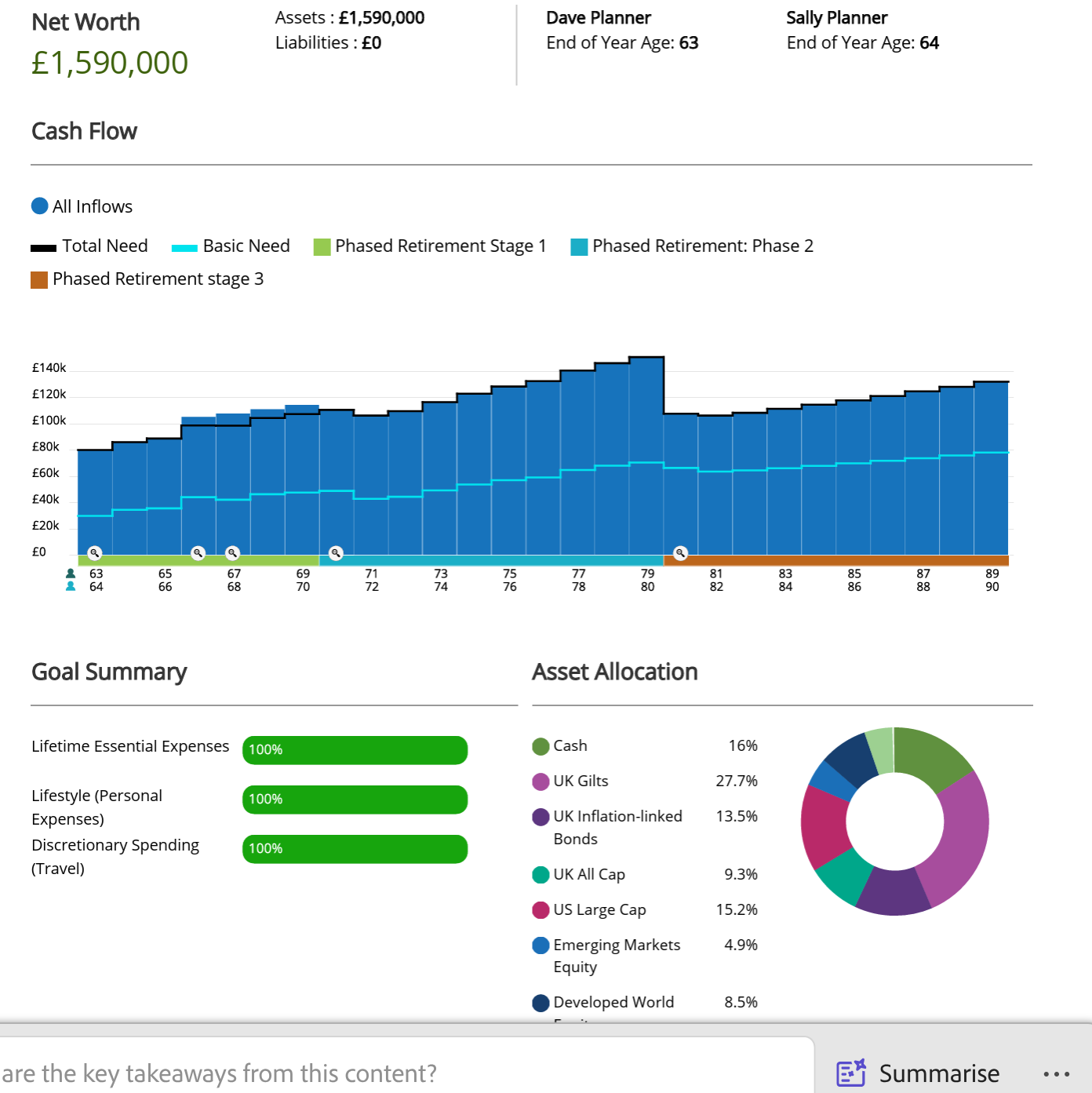

We’ll build a model of your financial future and we’ll discuss ALL the options. We’ll discuss the ‘‘Art of the Possible’’ - what do you want to do, what can you can - and what can you do safely, sustainably and with some confidence.

What impact will those decisions and choices make? We’ll show you…the art of the possible.

The art of the possible

We’ll show you what’s possible with your plan. It will be long-term. It will be sustainable. It will be within your risk appetite. It will be validated against the most respected, trusted assumptions and data available. It will be delivered for a fixed fee.

It will only be done when you say it is done.